Lebanon, a nation steeped in history and culture, has faced unprecedented economic challenges in recent years. Amidst the financial turmoil, the money transfer industry has emerged as a lifeline for many Lebanese families, providing a crucial conduit for remittances from loved ones abroad.

Traditionally, a few large players have dominated the Lebanese money transfer industry. However, driven by a combination of factors, including the economic crisis, the rise of digital technologies, and the growing demands of a tech-savvy diaspora, traditional money transfer operators are now facing increasing competition from mobile digital wallets and online remittance services. These new entrants, like Purpl, are bringing a wave of innovation and disruption to the sector, offering faster, cheaper, and more convenient ways for Lebanese expats to send money back home.

Factors Driving the Evolution of Money Transfer Services in Lebanon

Several key factors are contributing to the evolution of money transfer services in Lebanon:

- Economic Crisis and Increased Reliance on Remittances: Lebanon’s economic crisis has accelerated the reliance on remittances from the Lebanese diaspora making it essential for money transfer services to be efficient, accessible, and cost-effective. On top of that, the Lebanese lira has lost over 90% of its value, leading to a surge in demand for foreign currency, the US dollar. This has put a strain on traditional money transfer operators, which have been unable to meet the demand for dollars at the official exchange rate. As a result, many Lebanese expatriates have turned to informal channels, such as money changers and private individuals, to send money back home.

- The Downfall of the Lebanese Banking Sector: The economic crisis in 2019 started with the downfall of the Lebanese banking sector. This eroded public trust and depositors faced severe restrictions on accessing their money. This created a demand for alternative financial solutions. In addition, with restricted access to physical cash and traditional banking services, there was an increased need for online platforms that would allow people to perform basic transactions like paying bills, receiving money from family and friends abroad, and receiving salaries.

- Technological Advancements: The rise of digital technologies has opened up new possibilities for money transfers, enabling faster, more convenient, and more secure transactions. The emergence of digital wallets, like Purpl, have gained popularity due to their convenience and affordability, offering lower sending and receiving fees and faster transfer speeds compared to traditional money transfer agents.

- Demanding User Expectations: Lebanon has a large and active diaspora living abroad. This diaspora is increasingly tech-savvy and demanding more convenient and efficient ways to send money back home. New entrants in the money transfer industry are catering to this demand by offering mobile apps, online platforms, and user-friendly interfaces. Moreover, Lebanese users are increasingly tech-savvy and expect seamless, personalized experiences from their financial service providers.

Emerging Trends Shaping the Future of Money Transfers in Lebanon

In response to these factors, the Lebanese money transfer industry is undergoing a period of rapid transformation.

- Digital Transformation: Money transfer companies are investing in digital platforms, mobile applications, and online payment gateways to provide users with 24/7 access to their services.

- Diversification of Transfer Channels: Beyond traditional brick-and-mortar branches, money transfer companies are expanding their reach through mobile wallets, agent networks, and partnerships.

- Competitive Fee Structures: Recognizing the financial strain on Lebanese families, money transfer companies are striving to offer competitive fee structures and minimize remittance costs.

- Value-Added Services: In addition to basic money transfers, companies are introducing value-added services such as bill payments, mobile top-ups, and payment at merchants.

- Enhanced Customer Experience: Prioritizing customer satisfaction, money transfer companies are adopting data analytics and personalization techniques to deliver tailored and responsive services.

The Impact of Evolving Money Transfer Services on Lebanese Society

The evolution of money transfer services in Lebanon is having a significant impact on the lives of Lebanese citizens:

- Financial Inclusion: By providing accessible and affordable remittance services, money transfer companies are promoting financial inclusion, particularly among underserved communities.

- Economic Resilience: Remittances play a vital role in supporting the Lebanese economy, and efficient money transfer services contribute to their effective distribution.

- Social Well-being: Remittances enable families to meet their basic needs, support education and healthcare expenses, and contribute to overall well-being.

Purpl: Revolutionizing Money Transfers to Lebanon

In this landscape of change and opportunity, Purpl emerged as a lifeline for the Lebanese population with a mission to connect, empower, and enable financial access to all. We understood the struggles of Lebanese families waiting for days to receive their money transfer, paying excessive fees and navigating redundant processes.

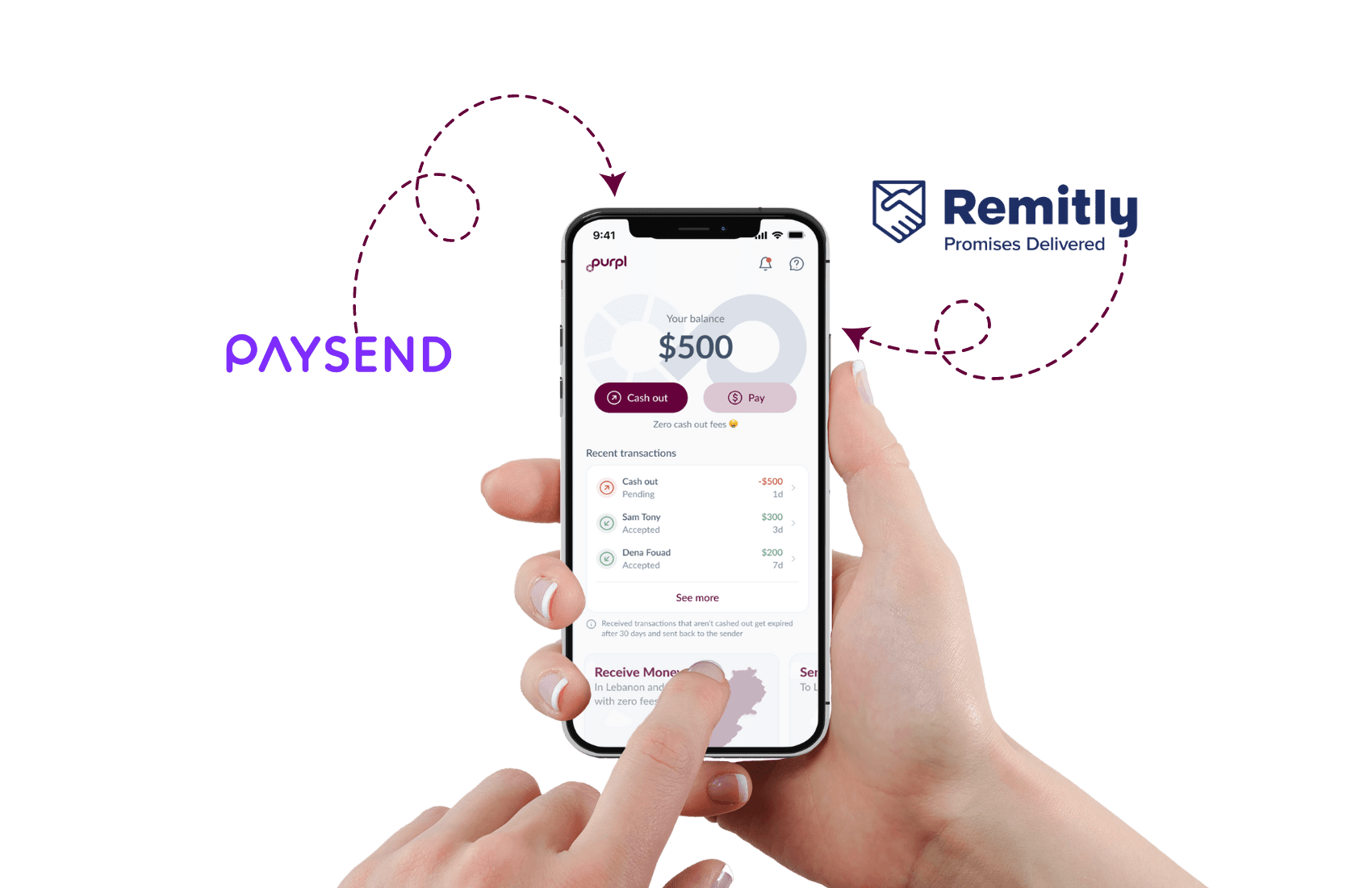

Purpl made money transfers to Lebanon completely digital, with low fees for the sender, zero fees for the receiver, instant, and more convenient than ever. With our digital remittance partners, Paysend and Remitly, sending money transfers to Lebanon can be done in a few seconds with the lowest sending fees. The recipient receives on Purpl and cashes out from 100+ ATMs of Banque Libano-Française in less than a minute and with ZERO fees.

Conclusion: Embracing the Future of Money Transfer in Lebanon

As the Lebanese money transfer industry continues to adapt and innovate, it is poised to play an even more crucial role in supporting the resilience and prosperity of the Lebanese people. By embracing technological advancements, prioritizing customer needs, and expanding service offerings, money transfer companies can empower Lebanese families and contribute to the nation’s economic recovery.

Written by: Mayssa Abillama